Crypto arbitrage trading is a strategy that capitalizes on price differences of digital assets across different markets, offering potential profits through various methods such as standard, spatial, decentralized, spot, P2P, and triangular arbitrage. While this approach presents opportunities for low-risk gains, it also involves challenges including market volatility, transaction speeds, and regulatory considerations, making it essential for crypto traders to understand both the advantages and risks before engaging in crypto arbitrage trading.

Standard Crypto Arbitrage

Standard crypto arbitrage, also known as cross-exchange arbitrage, is the most straightforward form of cryptocurrency arbitrage. It involves buying a cryptocurrency on one exchange where the price is lower and simultaneously selling it on another exchange where the price is higher, profiting from the price difference. For example, if Bitcoin is trading at $36,500 on Exchange A and $36,900 on Exchange B, an arbitrageur could potentially earn $400 per Bitcoin (minus fees) by executing this strategy. This method requires quick execution and constant monitoring of multiple crypto exchanges to identify and capitalize on price differences before they disappear due to market efficiency. While standard arbitrage can offer low-risk profits, challenges include transaction speeds, exchange fees, and the need for sufficient liquidity on both platforms to complete trades effectively.

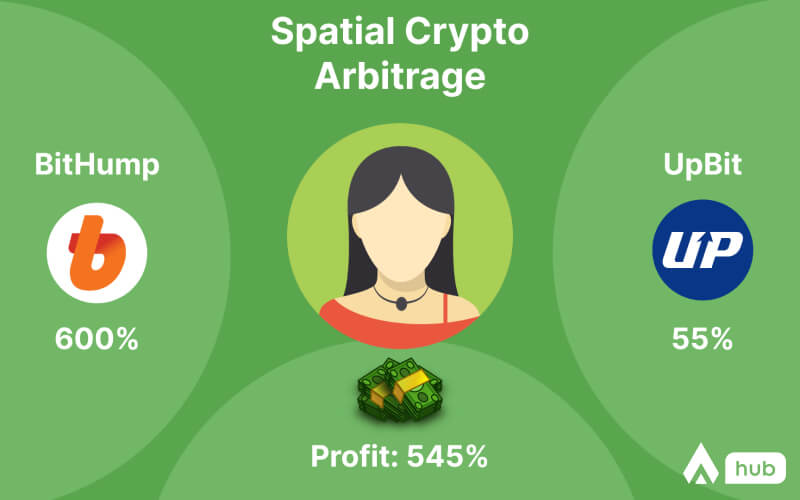

Spatial Crypto Arbitrage

Spatial crypto arbitrage involves exploiting price differences for cryptocurrencies across exchanges in different geographical locations. This strategy takes advantage of regional variations in supply, demand, and regulatory environments that can lead to significant price discrepancies. For example, South Korean exchanges have sometimes offered cryptocurrencies at substantial premiums due to local investor enthusiasm. In July 2023, Curve Finance (CRV) traded at a premium as high as 600% on Bithumb and 55% on Upbit compared to global markets following a protocol exploit. While spatial arbitrage can offer lucrative opportunities, it often comes with challenges such as restrictions on financial markets access in certain regions and the need to navigate different regulatory landscapes.

Decentralized Crypto Arbitrage

Decentralized crypto arbitrage capitalizes on price differences between decentralized exchanges (DEXs) or automated market makers (AMMs). This strategy exploits the unique pricing mechanisms of DEXs, which use smart contracts and liquidity pools to determine asset prices. Crypto arbitrageurs can profit by identifying and trading on price differences between DEXs or between DEXs and centralized exchanges. For example, if a token pair is priced differently on Uniswap compared to its spot price on centralized exchanges, traders can execute cross-exchange trades to capture the price gap. Decentralized crypto arbitrage often involves complex strategies like flash loans and trade batching, allowing experienced traders to execute multiple transactions in a single block without requiring upfront capital. While this form of arbitrage presents opportunities for profit, it also comes with risks such as smart contract vulnerabilities and the potential for front-running attacks.

Spot Crypto Arbitrage

Spot crypto arbitrage involves exploiting price differences between the spot market and futures contracts for cryptocurrencies. This strategy, also known as basis trading, allows traders to profit from the price discrepancy (basis) between spot and futures prices. For example, a trader might buy Bitcoin on the spot market at $30,000 and simultaneously sell Bitcoin contracts at $30,100, locking in a $100 profit per Bitcoin regardless of price movements at settlement. This approach can generate steady returns, as demonstrated in the BitMEX example where a 3.33% return was achieved. However, spot arbitrage requires careful calculation of contract sizes, consideration of leverage, and management of potential risks such as liquidation.

P2P Crypto Arbitrage

P2P crypto arbitrage involves exploiting price differences on peer-to-peer platforms where users trade directly with each other. This strategy allows crypto arbitrage traders to capitalize on diverse pricing options across different fiat currencies, cryptocurrencies, and markets. For example, a trader might find Bitcoin priced at $19,500 on one P2P platform and $19,700 on another, generating a profit by buying at the lower price and selling at the higher price. P2P arbitrage offers benefits such as direct transactions, flexible payment methods, and cross-border accessibility. However, it also presents challenges including longer transaction times, the need for quick action to seize opportunities, and potential risks of fraud on P2P platforms.

Triangular Crypto Arbitrage

Triangular crypto arbitrage is a complex trading strategy that exploits differences in price between three different cryptocurrencies. Traders execute a series of crypto arbitrage trades, converting one asset to a second, the second to a third, and finally back to the original asset, aiming to profit from the price differences. For example, an arbitrage trader might exchange USDT for BTC, then BTC for ETH, and finally ETH back to USDT, potentially earning a profit if the final USDT amount exceeds the initial investment. This strategy requires rapid execution and precise timing due to the volatile nature of crypto markets. Many traders employ automated trading bots to identify and capitalize on these fleeting opportunities. While triangular arbitrage can offer financial gains and contribute to market efficiency, it also involves risks such as high transaction costs and the need for substantial capital to generate significant profits.

Crypto Arbitrage Benefits

Crypto arbitrage offers several advantages for traders looking to capitalize on price discrepancies across different exchanges. Here are the key benefits:

- Low risk: Arbitrage trading is generally considered a low-risk strategy as it involves simultaneous buying and selling of assets to profit from price differences, reducing exposure to market volatility.

- Quick returns: Traders can potentially gain immediate profits after identifying and executing arbitrage opportunities, making it an attractive strategy for those seeking short-term gains.

- 24/7 trading opportunities: The cryptocurrency market operates around the clock, allowing arbitrageurs to monitor and capitalize on price discrepancies at any time of day.

- Market efficiency contribution: Arbitrage activities help to reduce price discrepancies across exchanges, contributing to overall market efficiency and liquidity.

- Diversification: Engaging in arbitrage trading allows traders to diversify their portfolio by investing in different markets simultaneously.

- Automation potential: Crypto arbitrage can be automated using trading bots, which can quickly analyze price differences across multiple exchanges and execute trades in seconds, enhancing efficiency and reducing human error.

- Opportunity for consistent profits: With proper execution and management of risks, arbitrage trading can provide a steady stream of small profits over time.

- Reduced impact of market volatility: Since arbitrage involves near-simultaneous buying and selling, traders can potentially profit regardless of overall market trends.

- Exploitation of market inefficiencies: The fragmented nature of the cryptocurrency market, with over 300 spot market exchanges, creates numerous arbitrage opportunities for savvy traders.

- Potential for high returns: While individual arbitrage trades may yield small profits, the cumulative effect of multiple successful trades can lead to significant returns.

Crypto Arbitrage Risks

Crypto arbitrage, while potentially profitable, comes with several risks that traders should be aware of. Here are the key risks involved in crypto arbitrage:

- Price fluctuations: Rapid price changes can erode potential profits if trades are not executed quickly enough.

- Counterparty risks:Moving assets between exchanges and banks exposes traders to the risk of institutional failures or bankruptcies.

- Hacking threats: Crypto exchanges are often targets for cyberattacks, putting funds at risk of theft.

- Delayed transactions: Blockchain congestion can slow down transactions, increasing exposure to market volatility.

- Technical issues: Real-time monitoring and trade execution can be hampered by system failures or slow execution times. To understand how artificial intelligence can address some of these risks and improve trading strategies, read our blog on AI in crypto.

- Security risks: Cryptocurrency exchanges are vulnerable to cyber attacks, potentially leading to loss of funds.

- Regulatory uncertainties: The lack of clear regulations in some jurisdictions can create legal risks for arbitrage traders.

- Market volatility:Market volatility: The highly volatile nature of cryptocurrency markets can quickly eliminate arbitrage opportunities.

- High fees: Multiple transaction fees, including trading, withdrawal, and network fees, can significantly impact profitability.

- Limited withdrawals: Many exchanges impose withdrawal limits, which can hinder the ability to move funds quickly for arbitrage.

- Small profit margins: Crypto arbitrage often yields small profits per trade, requiring substantial capital to generate significant returns.

- Liquidity issues: Lack of liquidity on certain exchanges can make it difficult to execute large trades or withdraw funds quickly.

- Execution risk: The need for rapid trade execution increases the chances of errors or missed opportunities.

- Exchange API limitations: Some exchanges may restrict the number of API calls, limiting the ability to monitor prices effectively.

- Front-running risk: In decentralized arbitrage, there's a risk of other traders front-running transactions, especially in high-volume situations.

By understanding these risks, traders can better prepare and implement strategies to mitigate potential losses in crypto arbitrage activities.

Crypto Arbitrage Step-by-Step

Crypto arbitrage trading involves a systematic approach to capitalize on price discrepancies across different exchanges. Here's a step-by-step guide for executing crypto arbitrage:

- Collect order book data from multiple exchanges for the assets you want to evaluate.

- Identify arbitrage opportunities by comparing bid and ask prices across exchanges.

- Calculate potential profits, considering that executing trades will consume the order book.

- Fund accounts on multiple exchanges to enable quick trades without time-consuming transfers.

- Execute the strategy by selling the asset on the exchange with the higher price and buying on the exchange with the lower price.

- Continue trading as long as the arbitrage opportunity exists, monitoring for changes in the order book.

- Stop trading when the opportunity disappears and start looking for new arbitrage chances.

This process requires quick execution, careful calculation of fees, and consideration of risks such as slippage and price movements. Traders often use automated bots to enhance speed and efficiency in identifying and capitalizing on these fleeting opportunities.

Trading bots in Crypto Arbitrage

Trading bots play a crucial role in crypto arbitrage, offering significant advantages in speed, efficiency, and precision compared to manual trading. Here's an overview of how trading bots are utilized in crypto arbitrage:

Automated Market Analysis

Crypto arbitrage bots can analyze multiple exchanges simultaneously, scanning for price discrepancies in real-time. For example, a bot might track Bitcoin prices on Binance, Coinbase, and Kraken, instantly identifying when the price on one exchange diverges significantly from the others. This rapid analysis is essential in the volatile crypto market, where arbitrage opportunities can appear and disappear within seconds.

Swift Execution

Once an arbitrage opportunity is identified, bots can execute trades instantly across different exchanges. This speed is critical in capitalizing on small price differentials before they vanish. For instance, if Bitcoin is trading at $35,000 on Binance and $35,100 on Coinbase, the bot can buy on Binance and sell on Coinbase almost instantaneously, capturing the $100 difference before human traders could react.

24/7 Operation

Unlike human traders, bots can operate continuously without fatigue. This is crucial in the crypto market, which operates around the clock. A bot might identify and execute profitable trades during off-hours when many human traders are inactive.

Elimination of Human Error

Bots execute trades based on predefined algorithms, removing emotional decision-making and fatigue-induced mistakes. For example, a bot won't hesitate to execute a trade due to fear or greed, ensuring consistent application of the arbitrage strategy.

Scalability

Arbitrage bots can handle a high volume of trades across multiple exchanges simultaneously. A single bot might manage trades across dozens of exchanges and hundreds of cryptocurrency pairs, a task that would be overwhelming for a human trader.

Types of Arbitrage Bots:

- Triangular Arbitrage Bots: These exploit price discrepancies between three different cryptocurrencies on the same exchange. For example, a bot might convert BTC to ETH, ETH to LTC, and then LTC back to BTC, profiting if the final amount of BTC is greater than the initial amount.

- Cross-Exchange Arbitrage Bots: These capitalize on price differences of the same cryptocurrency across different exchanges. For instance, buying Bitcoin on Binance at $34,900 and simultaneously selling it on Kraken at $35,000.

- Spatial Arbitrage Bots: These take advantage of price differences in different geographical regions. For example, exploiting the "Kimchi premium" where cryptocurrencies sometimes trade at higher prices on South Korean exchanges.

- Statistical Arbitrage Bots: These use complex mathematical models to identify and exploit short-term pricing inefficiencies. For instance, a bot might analyze historical price relationships between Bitcoin and Ethereum to predict and capitalize on temporary deviations from the norm.

- Decentralized Arbitrage Bots: These focus on price discrepancies across decentralized exchanges (DEXs). For example, a bot might exploit price differences between Uniswap and SushiSwap for the same token pair.

Key Features of Arbitrage Bots:

- Automated Trading: Bots execute trades based on preset parameters without human intervention. For instance, a bot might be programmed to execute a trade when the price difference between two exchanges exceeds 0.5%.

- Backtesting: Many bots allow users to test strategies using historical data. This feature enables traders to refine their strategies before risking real capital.

- Stop Loss: This feature automatically closes positions to limit potential losses. For example, a bot might be programmed to sell if the price drops by more than 2% after purchase.

- Push Notifications: Bots can send alerts about significant market movements or completed trades. A trader might receive a notification when their bot executes a large arbitrage trade or when market volatility increases.

- Portfolio Management: Some bots offer tools to track and manage overall crypto holdings, providing a comprehensive view of investments across multiple exchanges.

While arbitrage bots offer numerous advantages, they also come with risks. These include potential coding errors, the need for constant monitoring and updating to adapt to market changes, and the possibility of exploiting vulnerabilities in decentralized protocols. For instance, in 2020, a hacker exploited a vulnerability in the bZx protocol, using flash loans and arbitrage to drain nearly $1 million from the platform.

In conclusion, crypto arbitrage bots have become essential tools for traders seeking to capitalize on market inefficiencies. However, successful implementation requires a deep understanding of both the cryptocurrency market and the technical aspects of bot development and operation. As the crypto market continues to evolve, so too will the sophistication and capabilities of these automated trading systems.

Disclaimer

We do not provide financial advice. The information shared in this blog is for educational purposes only and should not be considered as financial guidance. It is crucial to check local legal regulations and guidelines before engaging in any cryptocurrency transactions, as certain jurisdictions can vary significantly depending on your jurisdiction. Additionally, we encourage you to conduct your own research (DYOR) and consult with a financial advisor to make informed decisions about buying, selling, or managing cryptocurrencies. Always consider your financial situation and risk tolerance before proceeding with any investment.

Pingback: AI Crypto: Learn how AI & Crypto Are Merging! - Altorise Hub

Pingback: Buy Crypto: Guide for Maximizing Returns! - Altorise Hub